Ready Steady Grow! 2019 is the best opportunity for entrepreneurs, investors and business advisers to meet and share knowledge on all the exciting funding options and growth financing for start ups and SMEs.

Here at The MAC, 10 Exchange Street West, Belfast BT1 2NJ we are bringing together small businesses, investors, funders, entrepreneurs and business advisers – all in one place to hear expert opinion from SME industry experts.

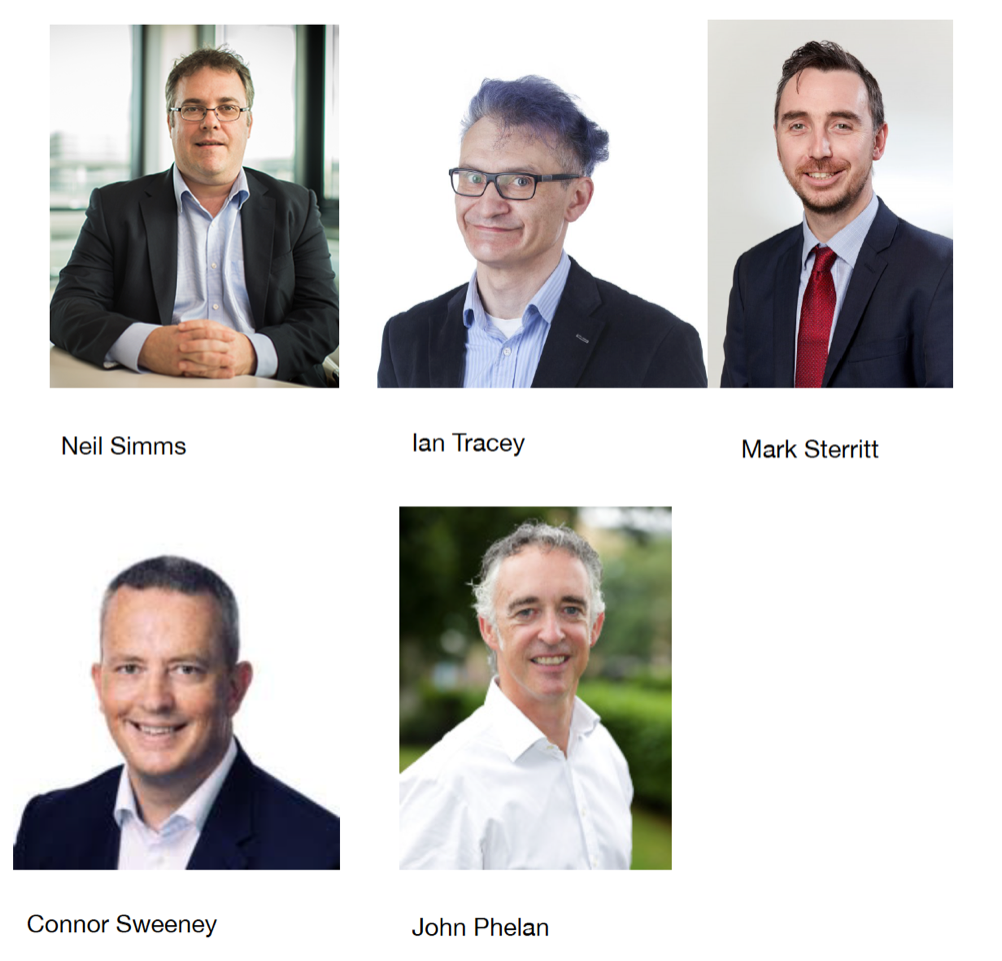

Speakers:

Neil Simms, Finance Director, Clarendon

Neil Simms is Finance Director of, and an Investment Manager with, Clarendon Fund Managers (‘CFM’), having joined the company in 2002. Neil has a BSc (Hons) in Economics and Econometrics from Nottingham University and is a member of the Institute of Chartered Accountants in Ireland, having trained and qualified with Ernst & Young in Belfast. Neil has either led or been heavily involved in negotiating and completing multiple investment rounds, and exits, in over twenty Northern Ireland based SMEs, across a broad range of sectors. He currently represents Funds’ interests on the Board of four portfolio companies.

Ian Tracey, Head of A2FF, The Knowledge Transfer Network

Ian is Head of Access to Funding and Finance at Knowledge Transfer Network (KTN). He is responsible for growing and developing KTN’s strategies for assisting innovative companies through the application and raising of finance – lending, grants, or equity based. Ian is the Secretary-General of HEPtech network at CERN. Formerly he was External Technology Transfer lead at the Science and Technology Facilities Council, where he also co-created the UK Innovation Forum, to find the management required by UK research institutions to fill posts in their spinouts, or otherwise participate in the commercialisation of new technologies. He started his career at BT Research Labs, in Martlesham.

Mark Sterritt, Senior Manager, British Business Bank

Mark Sterritt is a Senior Manager for Northern Ireland at the British Business Bank. The British Business Bank is the government-owned economic development bank dedicated to making finance markets work better for smaller businesses. The UK Network was originally announced as part of the Government’s modern Industrial Strategy in November 2017, with a remit to identify and help to reduce imbalances in access to finance for smaller businesses across the UK. The UK Network will help enhance business finance ecosystems across the UK so smaller businesses, wherever they are, can grow and prosper. It will also help the Bank develop a deeper understanding of small business finance markets in all parts of the UK so that, ultimately, the Bank can improve its support to smaller businesses everywhere. Mark represents the UK Network across Northern Ireland and engages closely with business finance stakeholders in the area.

Conor Sweeney, Venture Partner, Elkstone

Elkstone is investing in fast growing SMEs across Ireland and across nearly all sectors. We are currently focused on early stage equity investment opportunities. We have the capacity to invest from €250k up to €3m and we can access larger rounds of funding through our international network too. Elkstone Partners is a leading multi-family office group providing unique investment services to its Irish and international client base including wealth management, venture and real estate opportunities and alternative finance solutions. Elkstone Partners is the parent company of Elkstone Private which is a regulated entity that can provide our client base with an extensive range of MiFID investment services. Our focus is to proactively assist our clients in selecting investment opportunities that are directly tailored to their individual needs.

John Phelan, National Director, HBAN

John is commercially driven to identify, create and scale new business opportunities. He has grown and scaled companies, including his own, in Ireland, the UK and in the USA. These include several start-ups; one in the UK, three in Ireland (most recently RecommenderX AI) and GM of a games company in Chicago. His domain knowledge is in the AI, Software, ICT, MediaTech & Animation/content sectors. He is involved with all stages of funding (Equity, Debt, Grant, R&D) and stages of development from M&A exit transactions, Series A, Seed and R&D, and has also engaged in early stage Research (H2020 and the European Commission). Through his engagement with Dublin BIC, the Halo Business Angel Network, the AIB Seed Fund and Enterprise Ireland he has his “Finger on the Pulse” of entrepreneurial activity in Ireland. John is also the co-founder of RecommenderX, Chair of lifestyle learning content brands Knowhowdo and the Independent Chair of Animation Ireland with members employing over 1,500 and annual revenues ~ €100m.

Judging Panel:

Andrew Aldridge, Head of Marketing, Deepbridge Capital

As Head of Marketing, Andrew oversees all Deepbridge communications and messaging. Andrew has a wealth of experience marketing financial and professional institutions, with over a decade of experience building credible brands and delivering real growth. Andrew is a Member of The Chartered Institute of Marketing and holds a BSc in Business Economics and Marketing from the University of Wales, Aberystwyth. Andrew is also a trustee of the Tim Parry Johnathan Ball Peace Foundation.

Kealan Doyle, CEO, Symvan Capital

Kealan is CEO and co-founder of Symvan Capital. He has worked with venture capital companies for 15 years, both in a corporate finance advisory capacity as well as a fund manager. He prefers to invest in a wide range of technology companies, but is also very interested in finding synergies within the Symvan portfolio of companies. Company interests include big data analytics, fintech, SaaS, 3D printing and network security. Before his involvement in venture capital investing, Kealan previously lead a structured equity products team at HSBC, and has worked at Deutsche Bank, Merrill Lynch and UBS. Together with Nicholas, he has since founded his own entrepreneurial businesses to focus on VC investing. Kealan holds degrees from the London School of Economics and the University of Toronto.

James Sore

James’s passion for early stage investing and UK SME started young, the son of an entrepreneur it was in his blood. Having consulted for some of the world’s largest and successful brands for 5 years, he decided to leave the safety of a large organisation to explore the many benefits and pitfalls of building and running SMEs. This is when he also started my personal investment career. Over the last 10 years James has experienced the highs and lows of business first hand and it is a knows it is tough thing building companies, as he has done it, not always successfully but he has always learned and grown. In 2014, James joined Syndicateroom, a group of 4 people who were starting a business in a nascent industry, with little backing and a mountain of trials and opportunities ahead. In his 5 years, James helped grow SyndicateRoom to 30 people, 35,000 members and investments in over 180 companies. James managed five investment funds including the first and only passive fund for early stage investing, Fund Twenty8.

Through practical seminars, Q&As, panel discussions and networking, we review a wide range of funding options, including the government-backed Enterprise Investment Scheme (EIS) and Seed Enterprise Investment Scheme (SEIS).

We will also explore:

- Funding challenges facing small businesses

- How to make yourself ‘Investor Ready’

- How funding options such as the Enterprise Investment Scheme, Venture Debt, R&D tax credits and government funding can support you

- How investors and advisors can gain access to exciting new companies with strong growth potential!

Other Ready Steady Grow! 2019 events are taking place in:

MANCHESTER/LONDON/LIVERPOOL/EDINBURGH/BIRMINGHAM/BRISTOL/LEEDS/CARDIFF

FAQs

Who should attend this event?

Entrepreneurs looking to start a business, or access funding to take your business to its next level

Investors looking to invest in the ‘Next big thing’

Professional Advisors who want to help SMEs develop and grow.

Is there the opportunity for me to pitch my ‘Big Idea’?

Yes! If you are an entrepreneur looking for investment in your big idea, you can pitch your plans to investors and business advisors at this event – with just 5 minutes to pitch to our panel, they will offer you insight and advice directly relevant to your business idea! Email Mark Brownridge or Ceri Evans to secure your pitching spot!

Will refreshments be provided?

We will be serving pizzas, as well as beers, wine and soft drinks!

Register here